CRM for Private Banking

Explore Why the Leading Private Banks have Made us Their Trusted CRM Provider

Our CRM for Private Banking is designed to address your key business challenges and drive your business forward. Through our cutting edge, digital technology, we help provide superior service to the entire household to increase assets under management and retain assets upon transfer of wealth.

On top of delivering the superior performance, and usability associated with first generation Cloud Computing, our CRM for Private Banking product was built to address the integration challenges, inflating costs, and limited functionality faced by other CRM options currently in market.

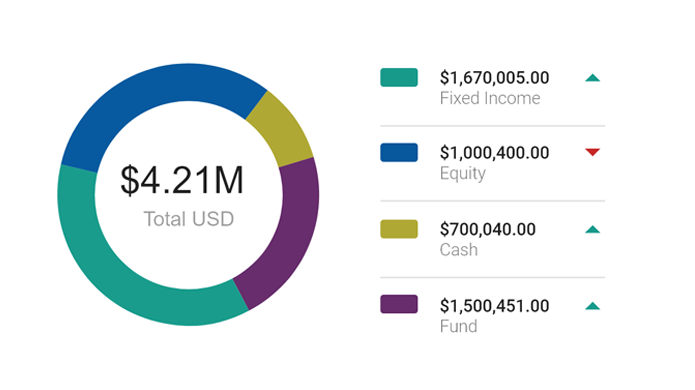

Designed to help consolidate all key information across your firm, our Comprehensive Customer View equips your Relationship Managers with the most informative, insightful and up-to-date information.

Learn More Comprehensive Customer View arrow_forward

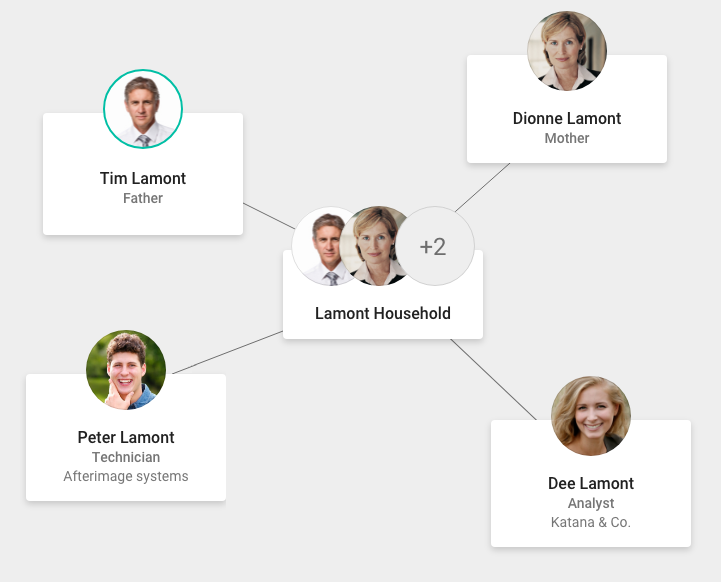

Developed to help establish and maintain householding for multiple customers living at the same address, and manage relationships for multiple customers living at different addresses, our CRM for Private Banking product provides flexible householding functionality to facilitate policy/account aggregation. It also facilitates the modeling of complex relationships including referrals, family relationships, related parties, trusts, companies, and ad-hoc relationships such as associations, or professional affiliations. Additionally, it facilitates calculating total customer value.

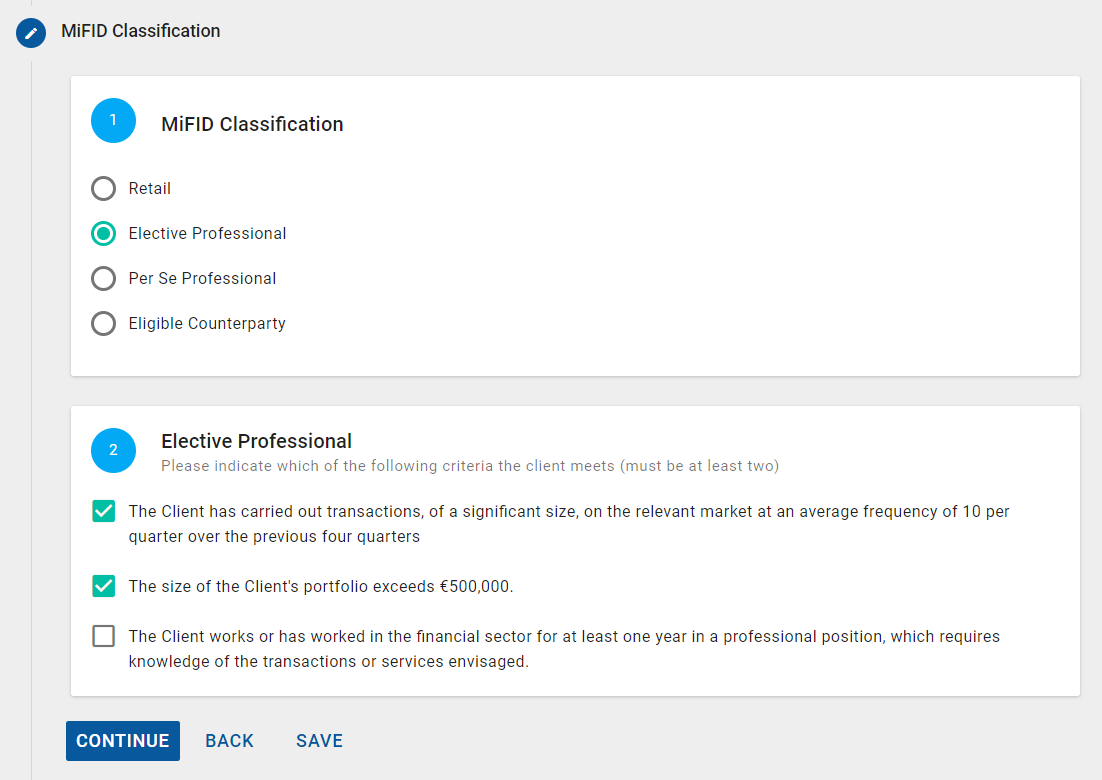

Learn More About Householding arrow_forwardAimed at streamlining the changing process of onboarding clients with complex products due to changing regulatory obligations and heightened customer expectations, our onboarding feature provides relationship managers the bandwidth to focus on providing their clients with personalized service.

Learn More About Onboarding arrow_forward

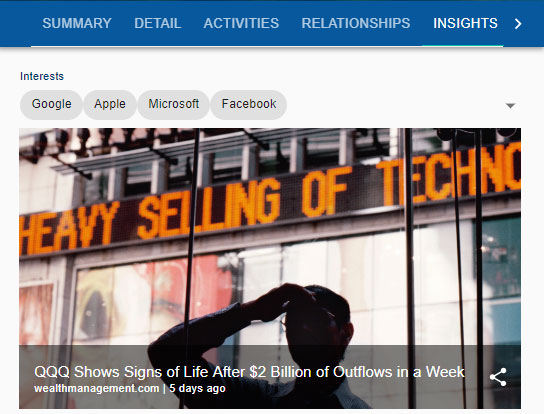

Designed to provide relationship managers with opportunities for interactions to promote retention and advocacy, our News and Research Recommendations feature is a built-in digital engagement service. It pulls relevant digital content from more than 15,000 third party publishers and filters it prior to distribution to ensure it complies with financial services regulations.

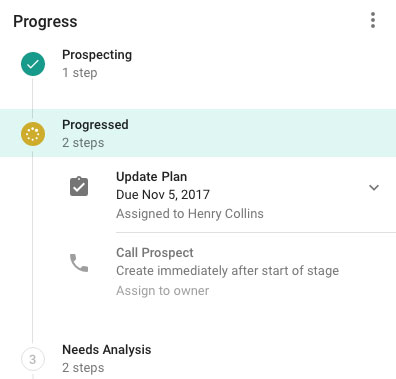

Learn More About News and Research Recommendations arrow_forwardBuilt to maximize the opportunities relationship managers receive, our opportunity management feature allows them to identify and track opportunities through the sales process and drives collaboration through key features (e.g. group calendaring and task management).

Learn More about Opportunity Management arrow_forward

Designed to help our capabilities run at full capacity, our key technology components

help drive our CRM forward.

We provide you 3 flexible deployment options to accommodate to your firm’s business needs: on-premise, hybrid and private cloud. We will also provide you a secure solution with full ownership of your data. Our point of differentiation is that your data is never co-mingled with that of other customers.

Learn More arrow_forwardWith our focus on integration and the customer experience, our CRM for Private Banking product addresses the challenges around processing large volumes of data from existing systems by providing relationship managers a consolidated, easy-to-use interface. This, in turn, drives adoption rates.

Learn More arrow_forwardOur rules-based SmartForms, workflows and activity plans are designed to standardize and automate scheduled and ad hoc processes. Not only do these tools reduce risk levels, resulting from human error, they enable relationship managers to focus on revenue-generating activities.

Learn More arrow_forwardOur rules engine, designed to enforce business rules company-wide, can be defined at any layer of the platform. At run-time, events, UI navigation, or business model updates, can set these rules to motion. Rules can be configured for our key capabilities and features, including: alerts & notifications, workflows, coverage, categories & custom fields, NexJ Nudge™️ and data validation.

Learn More arrow_forwardBased on visibility rules, our dynamic, flexible, and centralized security model will allow you to share information without worry. Founded on industry-wide standards, it allows us to directly map to existing security models and leverage existing entitlements models. Security rules are enforced by our main server and are centrally defined in the Business Domain Model. This way, they are applied across the board, regardless of your UI or access method.

Key components of our security model are: integrated user authentication, data visibility, functional entitlements and encryption.

Learn More arrow_forwardDesigned to address the constantly-changing regulatory environment, organizations are under increased pressure to comply with fiduciary and regulatory requirements. That’s where our extensive experience working with leading global financial institutions comes in. Not only do we specialize in helping firms meet their regulatory obligations, we integrate with local and regional policies and standards.

We also provide data virtualization capabilities that you can use to satisfy complex in-country and cross-border data residency requirements across multiple jurisdictions.

We can help you comply with industry and government standards and privacy regulations through key features: data virtualization, security, business rules, Smartforms & workflows, reporting and auditing.

Learn More arrow_forwardBook a demo today and learn why we are a global leader in the CRM space.

Book a Demo keyboard_arrow_rightWe will be happy to answer any questions or concerns you may have.

Contact Us keyboard_arrow_right Developer Community keyboard_arrow_right