Drive Efficiency and Collaboration through Our Opportunity and Pipeline Management Feature

Our Opportunity Management functionality for Commercial Banking allows bankers to identify and track opportunities from a single application window. Opportunities, which are assigned to clients, can also be tied to a campaign, service request, or entity. This data can then be aggregated along defined relationship hierarchies including client, product, assigned sales representative, or campaign to effectively manage the opportunity funnel.

Opportunity templates, which are based on best practices, are made up of configurable opportunity stages such as initial contact, follow-up meeting, proposal/contract, etc. Each stage contains an Activity Plan that automatically assigns next steps and attaches key documents to lead. These plans are run-time configurable and provide all workflow management between stages, including escalation of incomplete activities.

Drive Funnel Management via Our Pipeline Reports and Management Dashboards

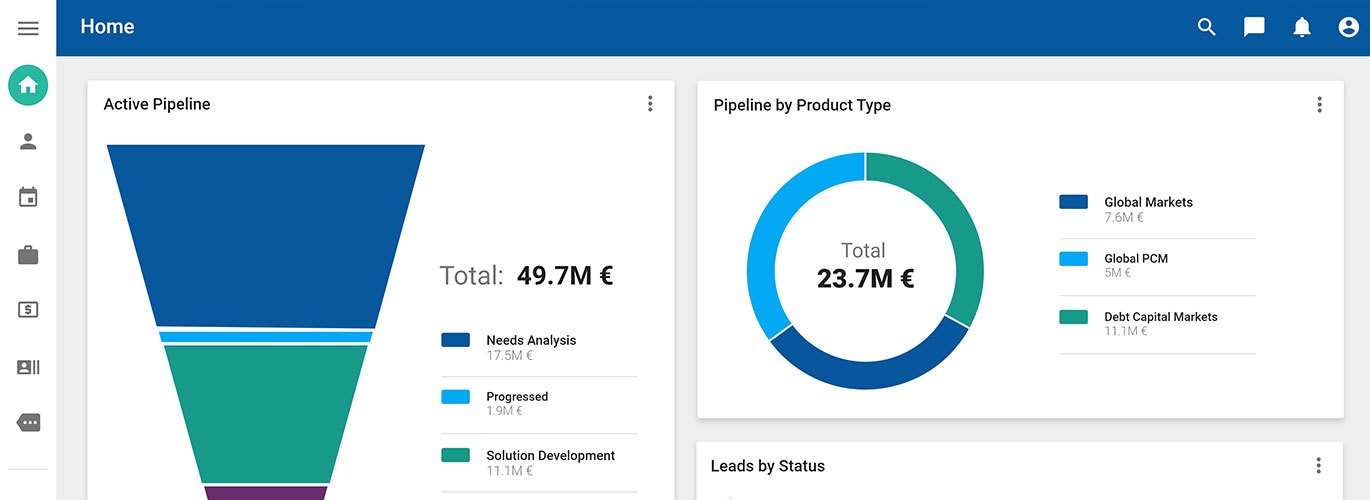

Bankers can track the sales process from start to finish through our pipeline reports and management dashboards. These summarize interactions, progress, status, and activities across all opportunity stages. To provide bankers with real-time information around leads, opportunities and accounts, and to consolidate sales information for the sales manager, we provide various reporting and graphical formats. These reports allow you to examine data at a granular level and conduct gap analyses.

From a communications perspective, bankers also have the opportunity to participate in “deal chatrooms” where they can exchange secure messages.

The Value that Our Opportunity & Pipeline Management Feature Provides You

- Drive opportunity identification to potentially increase revenue

- Increase success for institutions via best practices

And that’s just the beginning!