Streamlining the Client Onboarding Processes to Put Focus on Business Client Satisfaction

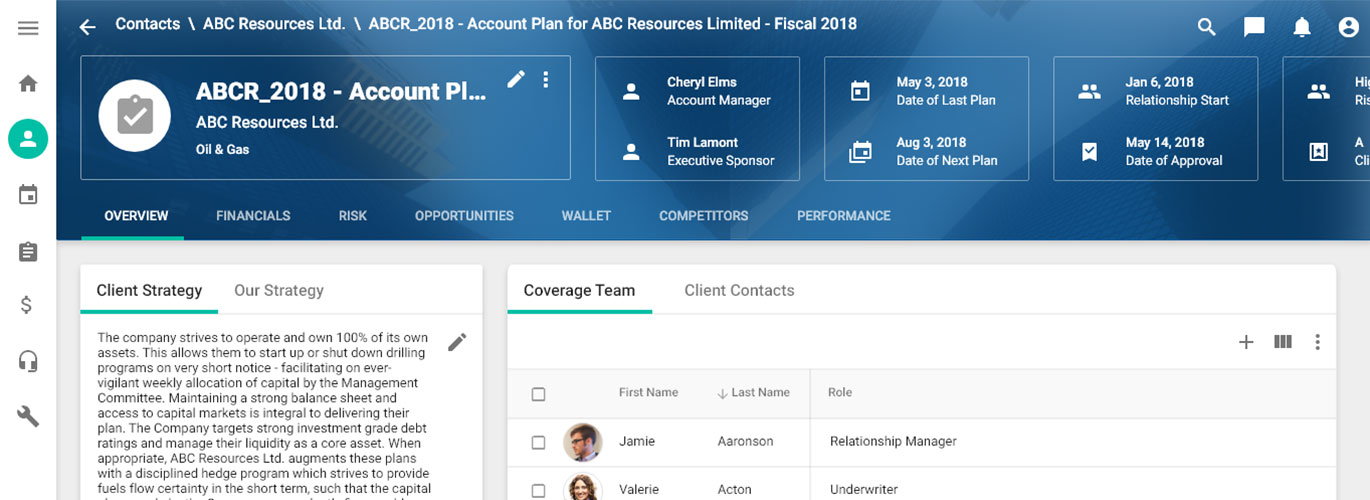

Our Guided Account Planning feature for corporate bankers streamlines the end-to-end process of opening, planning, and reviewing financial accounts. In particular, it helps guide data capture and the data validation process (via front end systems) to coordinate with account review and approval processes (via back office environments). For instance, it notifies bankers when they need to action a task and automatically sets the task status to complete when done.

Key Features and Benefits Include:

- Accelerated Approval Processes: This functionality also routes completed forms to approvers – automatically.

- Activity Plans and Service Level Management: These automate and standardize regular account review and planning processes through a set of sequenced tasks and schedule items assigned to bankers across the company (e.g. data deficiency resolution).

- Configurable Process: This has the ability to launch additional actions (e.g. Fee and Payment Schedule Notification, Account Transfers, and Trade Instructions). Also, forms, data definitions, and approval workflows are done through run-time configuration, allowing for heightened flexibility in creating, modifying, and deleting data as needed.

- Electronic Data Collection and Transfer: This prevents errors and omissions, eliminates redundant work, and enriches data quality around your client’s profile.

- Flexible Reporting Capabilities: This allows bankers to generate customized, graphical reports to track performance to plan. Through our reporting tool, bankers can build comprehensive, flexible, and customizable reports. Further, these can be shared with your clients to facilitate client reviews and for planning purposes.

- Integration with NexJ News and Research Recommendations: Business bankers can access client data housed in NexJ News and Research Recommendations, which indexes both internal documents and publicly-available external content. Key information such as competitive information or even target rates can be fed and used to proactively generate communication with the client.

The Value that Our Guided Account Planning Feature Provides You

- Drive upsell and cross-sell opportunities

- Expedite the client onboarding process

- Speed up the asset conversion process

- Boost business client satisfaction

And that’s not all!