CRM for Corporate Banking

Exceed Your Business Targets with our Corporate Banking-Specific CRM Product

Our Intelligent Customer Management solution leverages the power of artificial intelligence, machine learning, and analytics to help you strengthen trusted business relationships, drive upsell and cross-sell opportunities, and deliver personalized service.

By delivering a truly integrated CRM product that delivers on the real-time data requirements of each firm, we deliver a superior user experience, drive high user adoption rates and lowers the total cost of ownership.

Our CRM is designed to address your key business challenges and drive your business forward. Through our cutting edge, digital technology, we help attract new customers, modernize the sales and service model and help you meet regulatory requirements.

On top of delivering the superior performance, and usability associated with first generation cloud computing, our CRM for Corporate Banking product was built to have deeper banking specific functionality and superior integration capabilities than other CRM options.

Powered by artificial intelligence, our CRM capabilities equip business bankers to meet their business needs.

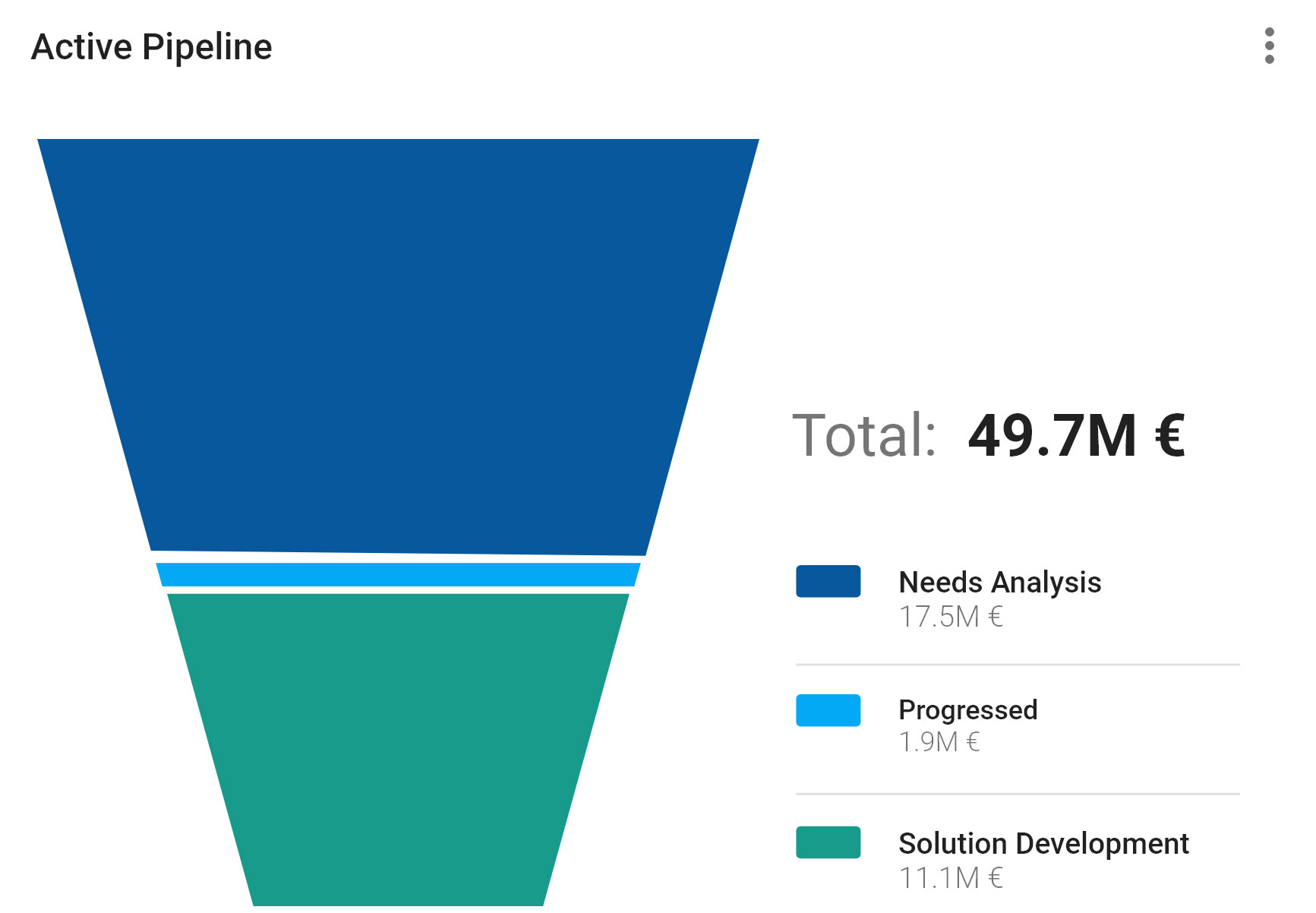

Developed to help manage complex, multi-product opportunities, our Opportunity & Deal Management capability allows business bankers to identify additional upsell and cross-sell opportunities throughout the various stages of the sales cycle. On top of that, it enforces best industry practices to boost performance.

Learn More About Opportunity & Deal Management arrow_forward

Aimed at providing business bankers additional bandwidth to better service their clients, our Guided Account Planning feature standardizes account review and planning processes using Activity Plans - a set of tasks and scheduled items assigned to appropriate users. In addition, it provides a guided form-fill process that takes bankers through questions they need to ask their clients in real-time to support planning activities.

Learn More about Guided Account Planning arrow_forwardDesigned to increase efficiency, our Call Reporting feature allows business bankers to log call to their client’s Interaction Journal within CRM for Corporate Banking. This process can either be automated through templates or through a workflow, or done manually. On top of that, this functionality documents call-related notes and distributes them to the appropriate users.

Learn More about Call Reporting arrow_forward

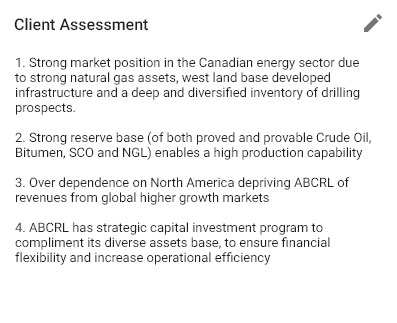

Developed to help business bankers profile and segment data, on top of analyzing client interactions and relationships, our Client Relationship Modelling features equips business bankers to make intelligent data-driven decisions. This way, they can identify spheres of influence, generate new opportunities, and calculate total customer value. Further, it allows them to automatically assign clients to the appropriate tier based on their value to action identified opportunities.

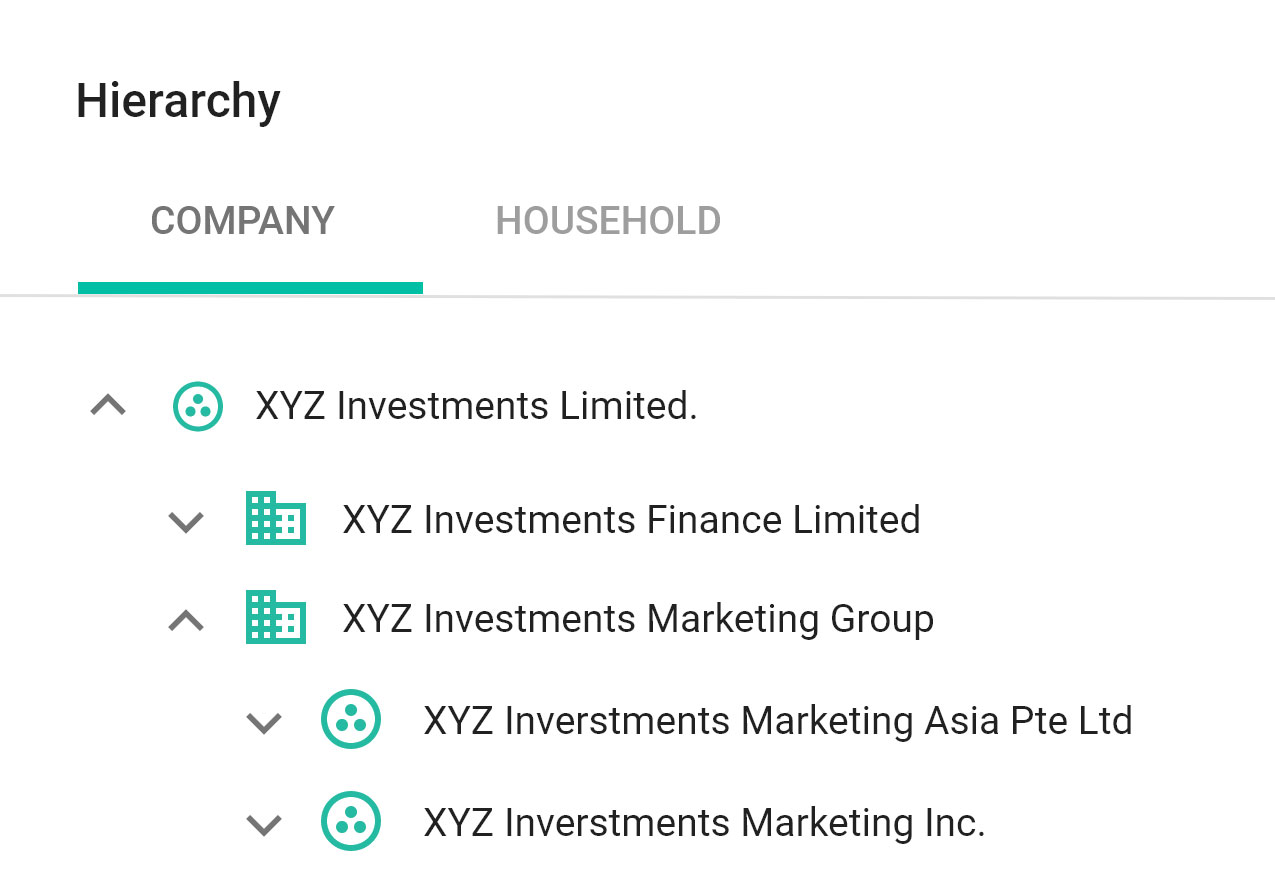

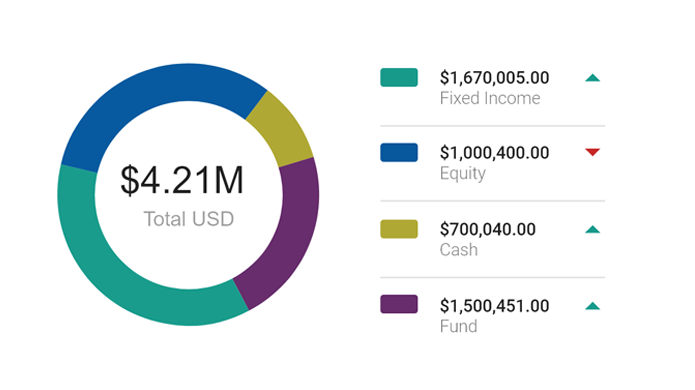

Learn More about Client Relationship Modelling arrow_forwardBuilt to consolidate all key information across your firm, our Comprehensive Customer View equips your business bankers with the most informative, insightful and up-to-date information.

Learn More about Comprehensive Customer View arrow_forward

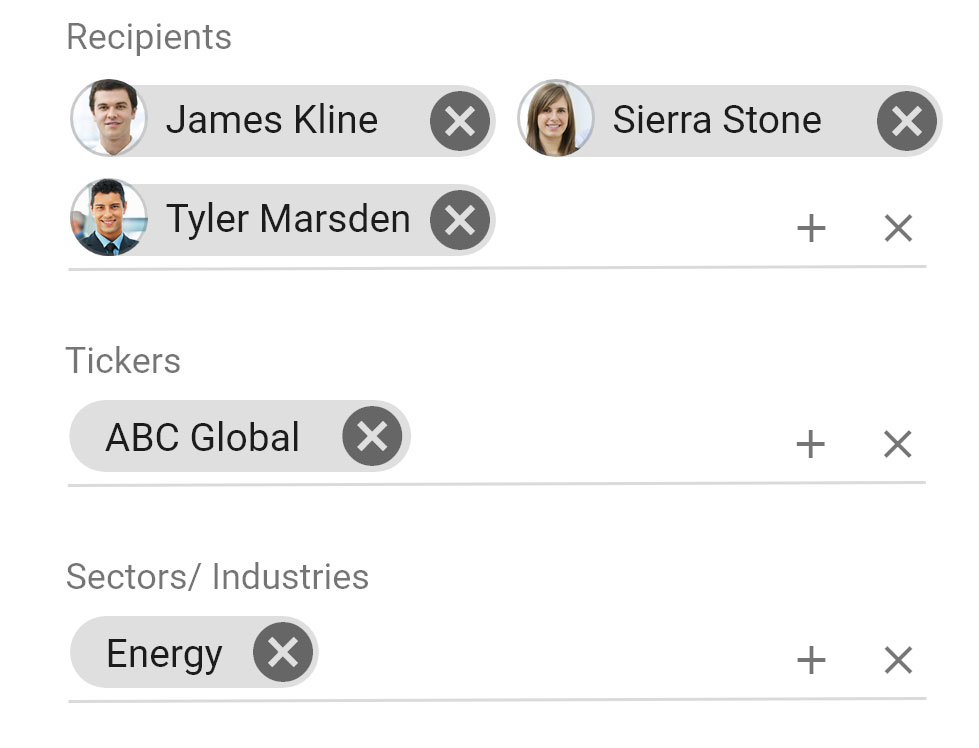

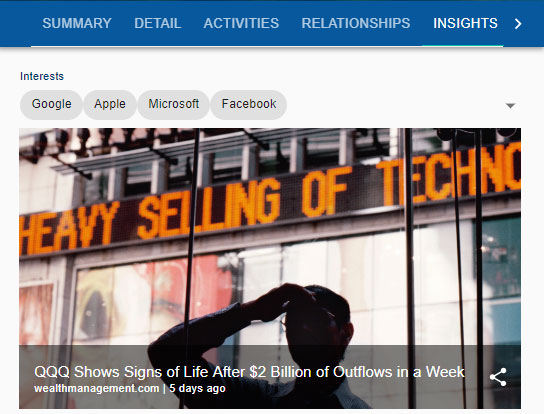

Designed to provide business bankers with opportunities for interactions to promote advocacy and retention, our News and Research Recommendations feature is a built-in digital engagement service. It pulls relevant digital content from more than 15,000 third party publishers and filters it prior to distribution to ensure it complies with financial services regulations.

Learn More About News and Research Recommendations arrow_forwardDesigned to help our capabilities run at full capacity, our key technology components

help drive our CRM forward.

Based on visibility rules, our dynamic, flexible, and centralized security model allows business bankers to share information without worry. Founded on industry-wide standards, it allows us to directly map to existing security models and leverage existing entitlements models. Security rules are enforced by our main server and are centrally defined in the Business Domain Model. This way, they are applied across the board, regardless of your UI or access method.

Key components of our security model are: integrated user authentication, data visibility, functional entitlements and encryption.

Learn More arrow_forwardDesigned to address the constantly-changing regulatory environment, organizations are under increased pressure to comply with fiduciary and regulatory requirements. That’s where our extensive experience working with leading global financial institutions comes in. Not only do we specialize in helping firms meet their regulatory obligations, we integrate with local and regional policies and standards.

We also provide data virtualization capabilities that you can use to satisfy complex in-country and cross-border data residency requirements across multiple jurisdictions.

We can help you comply with industry and government standards and privacy regulations through key features: data virtualization, security, business rules, Smartforms & workflows, reporting and auditing.

Learn More arrow_forwardBook a demo today and learn why we are a global leader in the CRM space.

Book a Demo keyboard_arrow_rightWe will be happy to answer any questions or concerns you may have.

Contact Us keyboard_arrow_right Developer Community keyboard_arrow_right