CRM for Commercial Banking

Take Advantage of Our Award-Winning CRM Product Designed for Commercial Banking

Our Intelligent Customer Management solution leverages the power of artificial intelligence, machine learning, and analytics to help you strengthen trusted relationships, drive upsell and cross-sell opportunities, and deliver personalized service. By delivering a truly integrated CRM product that delivers on the real-time data requirements of each firm, we provide a superior user experience, drive high user adoption rates and lowers the total cost of ownership.

Our CRM is designed to address your key business challenges and drive your business forward. Through our cutting edge, digital technology, we help attract new customers, reduce churn, modernize the sales and service model and help you meet regulatory requirements.

On top of delivering the superior performance, and usability associated with first generation cloud computing, our CRM for Commercial Banking product was built to have deeper banking specific functionality and superior integration capabilities than other CRM options.

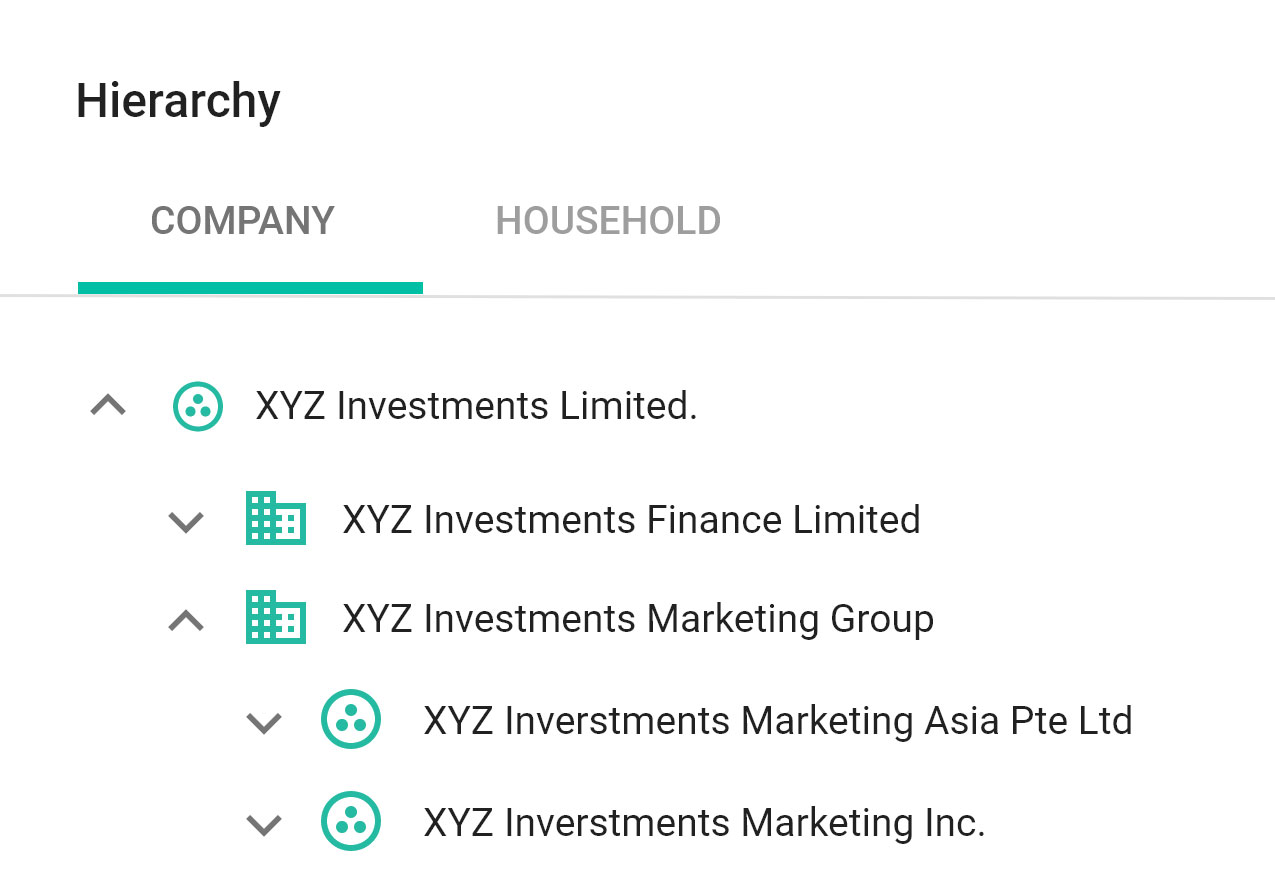

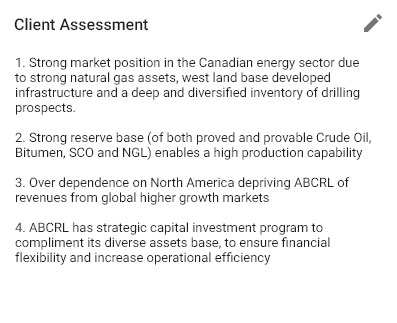

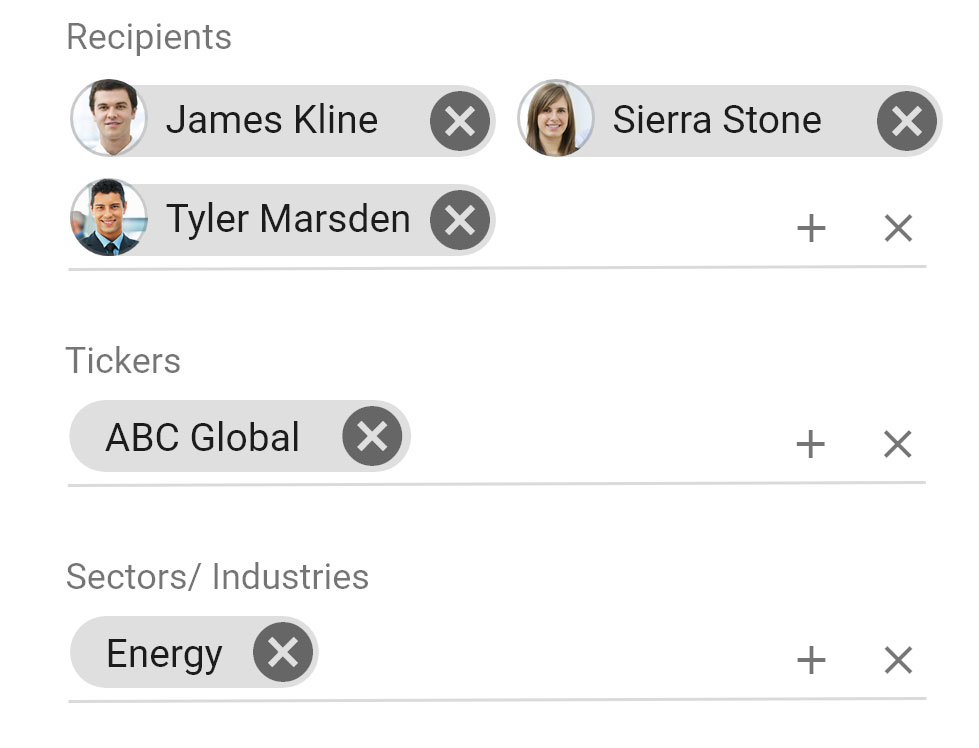

Built to consolidate all key information across your firm, our Comprehensive Customer View equips your bankers with the most informative, insightful and up-to-date information.

Learn More About Comprehensive Customer View arrow_forward

Developed to help bankers profile and segment data, on top of analyzing customer interactions and relationships, our Client Relationship Modelling feature equips bankers to make intelligent data-driven decisions. This way, they can identify spheres of influence, generate new opportunities, and calculate total customer value.

Learn More About Client Relationship Modelling arrow_forwardAimed at providing bankers additional bandwidth to better service their clients, our Guided Account Planning feature standardizes account review and planning processes using Activity Plans - a set of tasks and scheduled items assigned to appropriate users. In addition, it provides a guided form-fill process that takes bankers through questions they need to ask their clients in real-time to support planning activities.

Learn More About Guided Account Planning arrow_forward

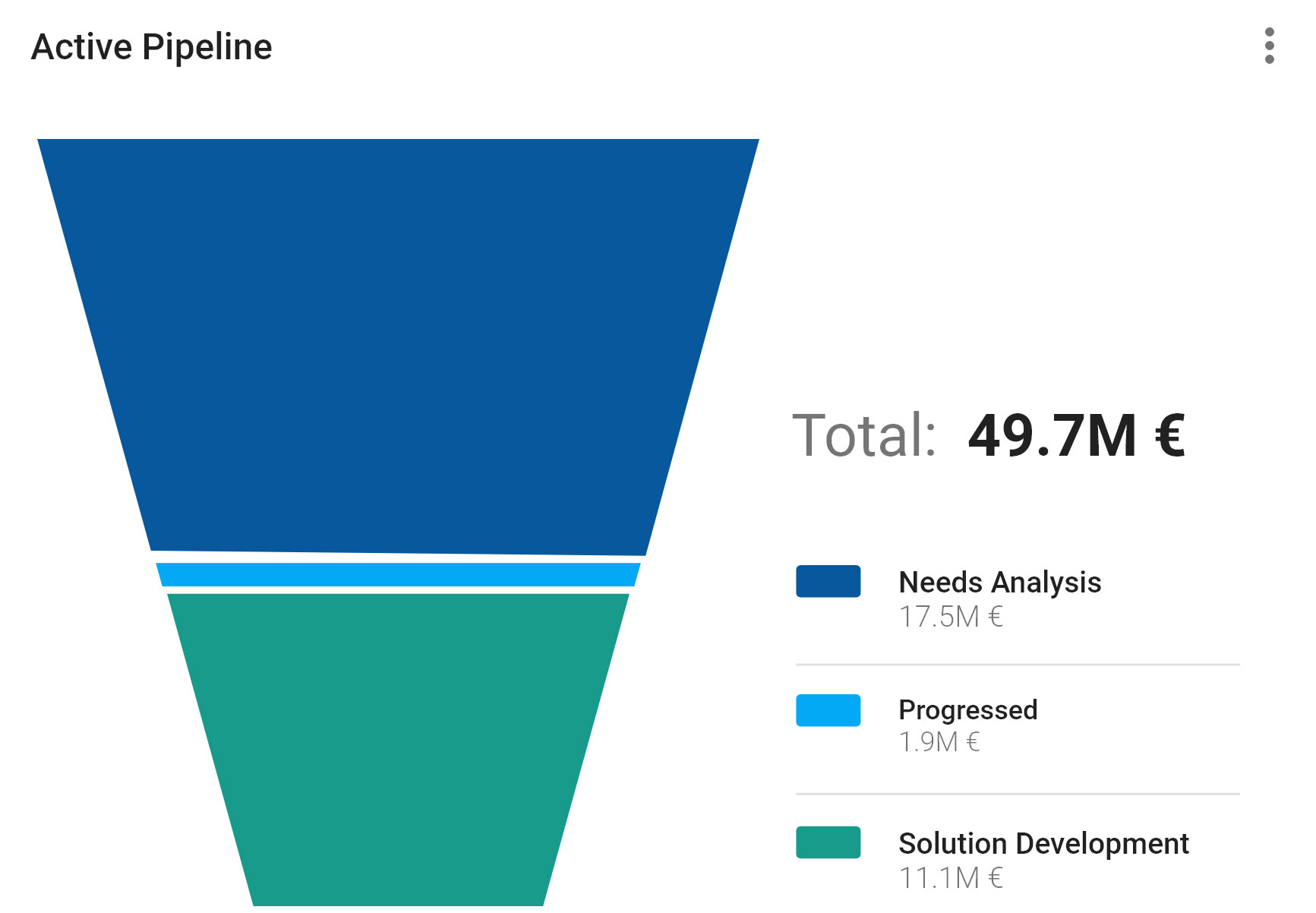

Developed to automate and enhance the sales cycle, our Opportunity and Pipeline Management feature leverages business rules to assign a sales team to an an appropriate opportunity, standardizes sales activities using templates, and automates sales processes using activity plans and workflows.

Learn More About Opportunity & Pipeline Management arrow_forwardDesigned to increase efficiency, our Call Reporting feature allows bankers to log call to their client’s Interaction Journal within CRM for Commercial Banking. This process can either be automated through templates or through a workflow, or done manually. On top of that, this functionality documents call-related notes and distributes them to the appropriate users.

Learn More About Call Reporting arrow_forward

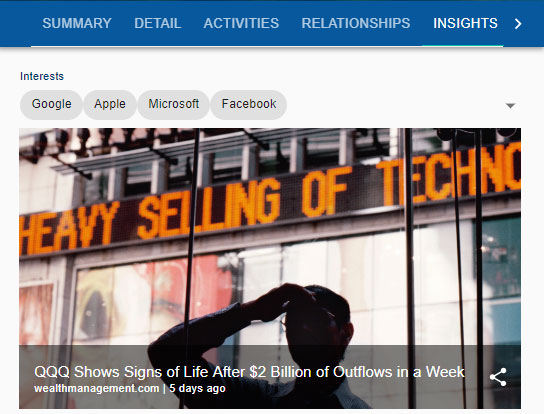

Designed to provide bankers with opportunities for interactions to promote retention and advocacy, our News and Research Recommendations feature is a built-in digital engagement service. It pulls relevant digital content from more than 15,000 third party publishers and matches them to the interests and profiles of specific clients.

Learn More About News and Research Recommendations arrow_forwardDesigned to help our capabilities run at full capacity, our key technology components

help drive our CRM forward.

Based on visibility rules, our dynamic, flexible, and centralized security model allows bankers to share information without worry. Founded on industry-wide standards, it allows us to directly map to existing security models and leverage existing entitlements models. Security rules are enforced by our main server and are centrally defined in the Business Domain Model. This way, they are applied across the board, regardless of your UI or access method.

Key components of our security model are: integrated user authentication, data visibility, functional entitlements and encryption.

Learn More arrow_forwardDesigned to address the constantly-changing regulatory environment, organizations are under increased pressure to comply with fiduciary and regulatory requirements. That’s where our extensive experience working with leading global financial institutions comes in. Not only do we specialize in helping firms meet their regulatory obligations, we integrate with local and regional policies and standards.

We also provide data virtualization capabilities that you can use to satisfy complex in-country and cross-border data residency requirements across multiple jurisdictions.

We can help you comply with industry and government standards and privacy regulations through key features: data virtualization, security, business rules, Smartforms & workflows, reporting and auditing.

Learn More arrow_forwardBook a demo today and learn why we are a global leader in the CRM space.

Book a Demo keyboard_arrow_rightWe will be happy to answer any questions or concerns you may have.

Contact Us keyboard_arrow_right Developer Community keyboard_arrow_right